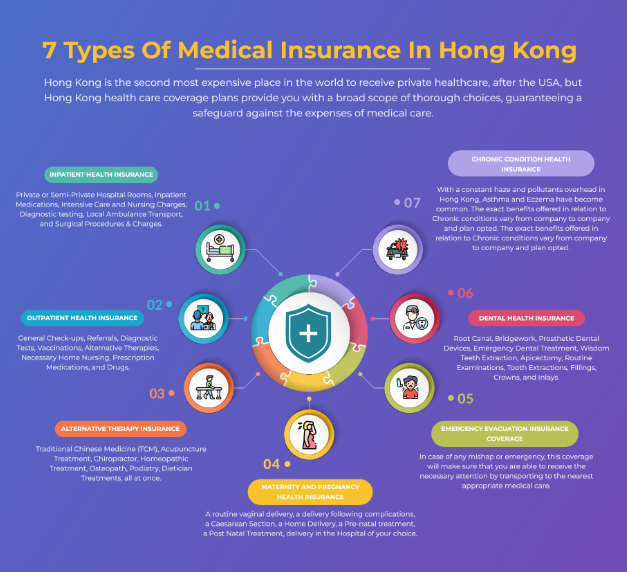

Hong Kong is the world’s second most expensive place to receive private healthcare, after the United States. Still, Hong Kong health care coverage plans offer a wide range of comprehensive options, ensuring a safeguard against medical care expenses. Below are the seven types of Medical Insurance in Hong Kong.

1. Chronic Condition Health Insurance

Because of the constant haze and pollutants overhead, asthma and eczema have become common in Hong Kong. However, chronic conditions are adequately covered by this coverage. The benefits for chronic conditions vary depending on the company and selected plan. Bowtie Medical Insurance provides a Cancer Insurance plan at a reasonable price that includes a benefit package.

In contrast to traditional insurers, which can take up to three weeks to process applications, Bowtie provides instant quotes and a concierge service team dedicated to assisting you throughout the process.

2. Alternative Therapy Insurance

This medical coverage includes Dietician Treatments, Acupuncture Treatment, Osteopathy, Chiropractor, Homeopathic Treatment, Podiatry, and Traditional Chinese Medicine (TCM).

3. Emergency Evacuation Insurance Coverage

Suppose a local hospital cannot provide you with treatment due to an accident or emergency. In that case, this coverage will ensure you receive the necessary attention by transporting you to the nearest appropriate medical care.

4. Maternity and Pregnancy Health Insurance

With the cost of giving birth in Hong Kong reaching new heights, this coverage will cover the costs of standard vaginal delivery, a home delivery, and prenatal treatment, delivery due to complication, postnatal treatment, a Caesarean Section, and delivery in the hospital of your choice.

5. Inpatient Health Insurance

Overnight hospital care costs more as you age and can be more expensive than all other medical bills combined. It covers the costs of Private or Semi-Private Hospital Rooms, Local Ambulance Transport, Intensive Care and Nursing Charges, Diagnostic Testing, Inpatient Medications, and Surgical Procedures and Charges.

6. Outpatient Health Insurance

Hong Kong outpatient coverage benefits are intended to make your daily healthcare experiences and doctor’s visits as simple as possible. It usually includes coverage for Drugs, General Check-ups, Referrals, Vaccinations, Alternative Therapies, Diagnostic Tests, Prescription Medications, and Home Nursing.

7. Dental Health Insurance

Dental coverage in Hong Kong typically protects you from the costs of Wisdom Teeth Extraction, Root Canal, Fillings, Prosthetic Dental Devices, Bridgework, Emergency Dental Treatment, Apicectomy, Routine Examinations, Tooth Extractions, Crowns, and Inlays, in addition to an existing Inpatient insurance.

How to Get Health Insurance in Hong Kong

The Hong Kong, Food and Health Bureau has established the Voluntary Health Insurance Scheme (VHIS) initiative to assist you in better understanding the local health insurance market. This scheme enables businesses to submit insurance policies and be certified per specific standards. All qualifying policies are listed on the website and presented next to one another, allowing customers to compare their options and select the best ones.

Bottom line

After you’ve established the best medical insurance plan, it’s also essential to know the crucial factors to consider when comparing health plans, including the less tangible benefits that aren’t always written down.

Also Read: Healthcare Staffing and Recruiting Trends for 2022